Five Things You Should Know Before Investing in Debt

Debt can help finance a purchase or improve your finances. However, you must be aware of all the outcomes before taking on a financial obligation. Why do we say this? Because debt is like a two-edged sword!

Using debt wisely can build wealth. But too much debt can lead to disaster. It can result in loan defaults, bankruptcy, or homelessness. For those who are unaware, here are some things to think about before getting into debt.

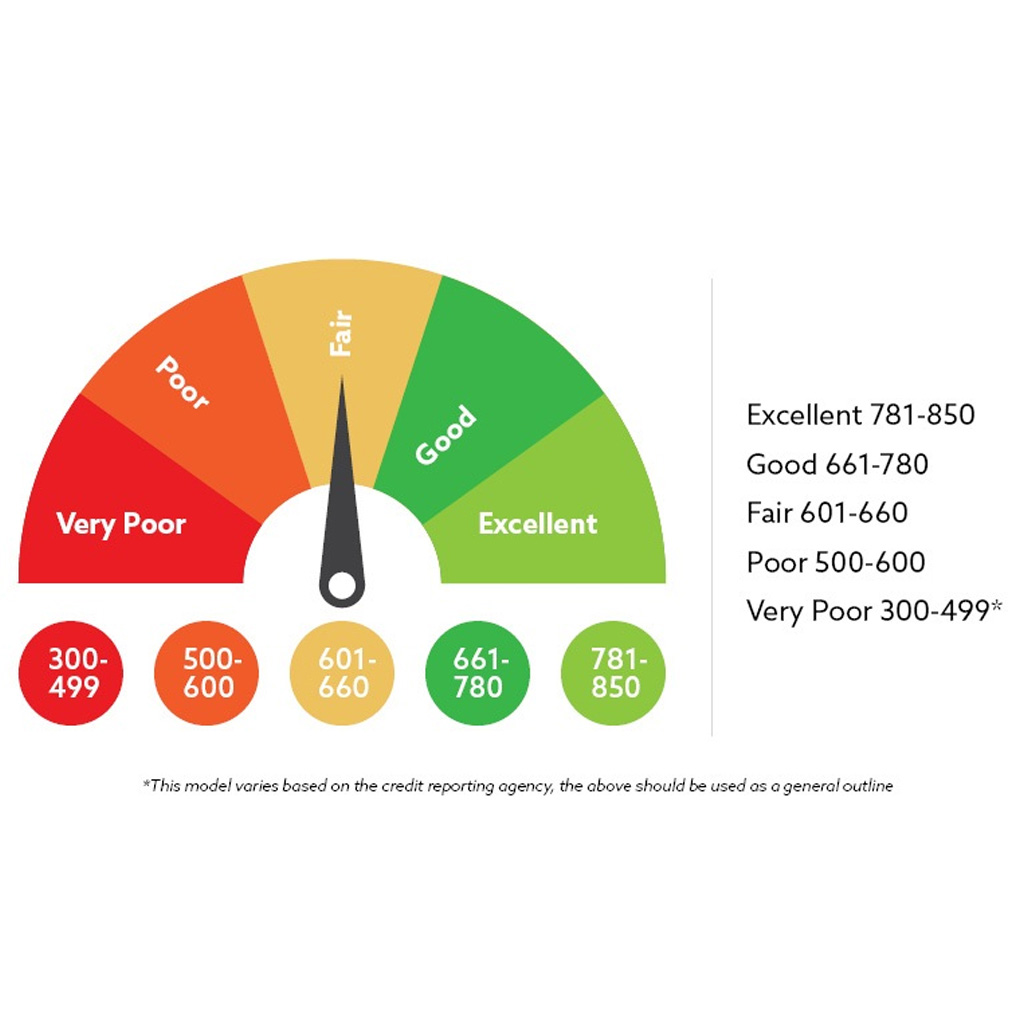

Know about your credit score in detail.

Your credit score is important for getting a loan or a personal credit rating. It’s a number that shows how creditworthy you are. This score is based on all your debts, including consumer, mortgage, student, and car loans.

Before applying for a loan, it’s important to know your credit score.

Credit scores usually range from 350 to 850. Lenders check your credit score to assess the risk of you defaulting on a loan.

●A score of 300 to 549 is considered bad with a high risk of default.

●A score of 550 to 619 is poor with a high risk of default.

●A score of 620 to 678 is fair with a medium risk of default.

●A score of 680 to 739 is good with a low risk of default.

●A score of 740 to 850 is excellent, with the lowest risk of default.

The average credit score in the U.S. is 698, but it varies by state.

A high credit score can help you get a loan with a lower interest rate. A low credit score may lead to higher interest rates and fewer banks willing to approve your loan.

Some of the factors that can affect your credit score include payment history, amount you owe, length of credit history, availability of balance in the bank, number of open accounts, and number of loans.

Understanding APR: annual percentage rate.

Annual percentage rate, or APR, is the amount of interest charged on a loan’s outstanding balance in a year. It includes both interests and other charges over the period of time. APR fluctuates depending on the types of loans and the lender.

For example, bank loans usually have higher interest rates compared to those offered by credit unions.

A low APR can mean cheaper borrowing. It saves you money by reducing the amount you pay in interest over time. This can help you pay off debt faster. In case you require a house, education, or investment loan, compare rates from different lenders.

A high interest rate can add thousands to your loan’s cost. Even a 1% lower interest rate can save you hundreds of dollars each year.

Document preparation should be prioritized.

To acquire a loan, you need to apply and provide some documents that confirm you satisfy the eligibility criteria. In most cases, these documents can be found on the bank or financial institution’s website.

The typically required list of documentation includes:

●Evidence of revenue like last year’s pay slips, starting from January.

●Proof of address, such as a statement from the bank.

●Verification of employment, for instance, an offer letter.

●Identification proof, like a copy of your identity card.

Additionally, most lenders will look at your account balance history stretching back 60 days prior to approving your loan. After confirmation of your documents, the lender will either approve or deny credit. This decision is generally based on your credit score, among other factors.

Make sure you understand the nitty-gritty details about the loan.

Before signing anything, make sure you understand the loan agreement. Many people sign loan agreements without reading them. This can be a huge mistake. Loan agreements have terms that can be confusing. They include conditions the borrower must accept to get the loan.

Common terms are interest rates, repayment schedules, loan terms, and loan forbearances.

●Interest Rate Clause: Sets the interest rate on the loan.

●Amortization Schedule Clause: Defines how often the loan will be paid off.

●Loan Term Clause: States the length of the loan.

Understanding these terms is crucial. It helps you decide whether to sign the agreement.

You might also want to talk to a lawyer or financial advisor. They can explain complex legal terms and highlight potential risks. Understanding the agreement fully can save you from unexpected financial issues later and help you manage your loan better.

Ensure you know how you are going to repay the debt or loan.

Before borrowing, it's important to know how you will repay the debt. Debt and loans can be useful, but repayment planning is key.

Are you going to use your monthly income to offset the debt? Or will you repay with your business proceeds? Depending on the situation at hand, which approach should be taken? - These are just some of the common questions that run through everyone’s minds.

Speaking with a financial advisor can help you find the best way to pay off your debt.

To pay off debt effectively, remember a few key things. First, make a budget and stick to it. This will show how much you can put toward your debt each month.

There are two common methods for repaying debt:

●Debt Snowball Method

This method involves paying off debts from smallest to largest, regardless of interest rate. It motivates you by quickly eliminating smaller debts.

●Debt Avalanche Method

This strategy focuses on paying off the debt with the highest interest rate first. It's financially smart but can be discouraging because it takes longer to see progress.

Each of these debt repayment methods has pros and cons. Choose the one that suits you best.

Struggling with debts can wreak havoc on an individual’s self-confidence, finances, and even personal life. There is no worse feeling than anticipating bankruptcy or your personal property or home being taken away.

Following these crucial tips above can help one understand the debt concept better, which will make them more vigilant the next time they apply for a loan.

By being proactive and informed, you can regain control over your financial situation and avoid the stress and uncertainty that debt can bring.

OTHER NEWS

-

- Why Should all Young People Have a Credit Card of Their own?

- By Little Grapes 24 Apr,2023

-

- How Much do you Know About the Hidden Costs of Buying a Home in the US, Apart From the Down Payment and Mortgage?

- By Anna 24 Apr,2023

-

- Five Best AI Stocks to Buy

- By Prodosh Kundu 27 Aug,2024

-

- Credit Card Debt Problems for Americans!

- By Wendy 26 Feb,2024

-

- Salvaging Credit Cards with Low Credit Scores: Tips and Strategies for Financial Recovery!

- By Wendy 24 Apr,2023

-

- The Rise of Tech Stocks: Five Key Areas Investors Should Watch

- By Prodosh Kundu 24 Jun,2024

-

- Different Home Loans for Buying a Home in the USA

- By Anna 24 Apr,2023

-

- What Does a Real Estate Agent do?

- By Anna 24 Apr,2023

-

- How do I buy Insurance?

- By Little Grapes 24 Apr,2023

-

- How to Analyze Market Trends to Make Informed Decisions

- By Muhammad Talha 16 May,2024

-

- About Real Estate, These you Need to Know!

- By Little Grapes 24 Apr,2023

-

- Real Estate Investment Needs to be Careful!

- By Little Grapes 24 Apr,2023

1

1 1

1