The Buy Now Pay Later Space Is Getting More Competitive in Europe, As New Startups Sprout Up

For now, Klarna, a fintech company, is the top player in the European BNPL (Buy Now Pay Later) market. The Swedish company is now valued at $11bn and is Europe’s second most highly valued startup, allowing shoppers to defer payments on goods at no cost.

But a report from fintech news site Sifted suggests that Klarna’s leading position is also being threatened by a host of new BNPL startups. Among them are Scalapay, Twisto and France’s Alma, who all announced fundraises of between €16m and €49m in January 2021.

This follows a record funding year in 2020 for the BNPL sector, which raised $1.5bn globally according to CB Insights. A fortnight ago, Affirm, a consumer finance company, also completed its U.S. listing.

Meanwhile, Klarna operates in 12 European countries, having recently expanded into Italy. It acquired fintech company Moneymour there in 2020.

The European BNPL Market Is Still in Its Infancy

With so many new players joining, Klarna’s CEO Sebastian Siemiatkowski says the company is aware of the threat posed by competing products. He told Sifted recently that he’s more worried about the recent sprouting of startups in the European market than traditional fintech companies like PayPal.

At the same time, the European BNPL market is still in its infancy. “You’ve actually got no real European player yet,” Alma chief Louis Chatriot tells Sifted. “Klarna is missing from France, Central Europe, and more.”.

Alma now plans on filling Klarna’s gap itself by offering merchants a comprehensive offering across Europe, buoyed by its latest €49m Series B.

Investment Boom

Despite continued questions about the ethics of BNPL, many investors are eager to gain a foothold in this fast-growing segment of the market, and the total amount of BNPL corporate financing in the global market is increasing year by year.

The average deal size in 2020 was $113m, compared to just $26m in 2018. This boom is linked to BNPL’s growing popularity, especially in Europe.

By 2025, BNPL volumes in Europe are predicted to hit $357bn, constituting nearly half of the entire global estimate, and 30% of all estimated ecommerce spend. Already in the UK, £4 in £100 in the UK is spent using BNPL, proving especially popular among millennials and Gen Z and soaring further during lockdown.

The benefit for BNPL providers is they take an average cut of 3% of the entire transaction base. This has given way to a pretty resilient business model. These startups’ merchant base constitutes an attractive asset.

Recently, Spanish BNPL player Pagantis was recently acquired by fintech company Clearpay as part of its expansion strategy. In addition, the stock markets also seem to be optimistic about the future of the BNPL sector, with many BNPL companies trading at many multiples their revenues.

Fierce Competition

Nonetheless, it’s worth remembering that Europe’s BNPL newcomers also face competitive pressure from traditional big players. Among them are PayPal, Amazon and American Express, who all recently launched 0% installment payment options.

In addition, Australian fintech firms like Zip, Laybuy and Afterpay (owner of Clearpay) have unveiled plans to spread into continental Europe. They could undercut startups like Twisto, who so far have enjoyed a near-monopoly in their native countries.

What’s more, many startups rely on only a few large customers, which puts them at a particular disadvantage when they face competition. Affirm, for example, gets 28% of its revenue from the fitness equipment company Peloton.

OTHER NEWS

-

- A 9-year-old Boy Earning 200 Million Per Year Through Toy Evaluation, Why Could This New Generation of Bloggers Take the Lead? (I)

- By Ward 24 Apr,2023

-

- With Mobile Payments Gaining Momentum, Can PayPal Still Take a Leading Position?

- By Scott 24 Apr,2023

-

- The largest mammoth fossil has been discovered in Mexico

- By Sandra 24 Apr,2023

-

- Handheld Mobile Game, the Special Experience with GameSir X2

- By Shawn 24 Apr,2023

-

- Facebook Adds Carts to WhatsApp to Make Shopping Easier

- By King 24 Apr,2023

-

- Grab‘s Dominant Position in Indonesia’s E-payment?

- By Heather 24 Apr,2023

-

- Pi star: A planet with a 3.14 Day Orbit

- By Anne 24 Apr,2023

-

- How to Get Free Wi-Fi Networks Correctly and Safely?

- By Beverly 24 Apr,2023

-

- A 9-year-old Boy Earning 200 Million Per Year Through Toy Evaluation, Why Could This New Generation of Bloggers Take the Lead? (II)

- By Ward 24 Apr,2023

-

- What are Global Users From Shazam Meant to Apple?

- By Smith 24 Apr,2023

-

- Rough user portraits of Gen Z mobile game players

- By Heather 24 Apr,2023

-

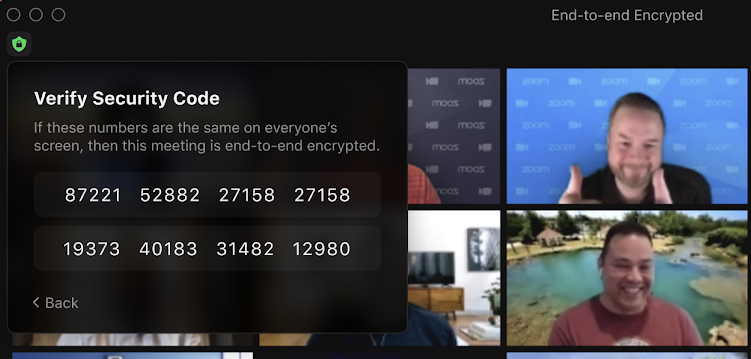

- Zoom’s New Update: End-to-End Encryption

- By Antonio 24 Apr,2023

1

1 1

1